I don’t think it was a coincidence that #HSAAwarenessday occurred right before Open Enrollment, nor was it a coincidence that I decided to write a blog post on HSAs (Health Savings Account) at the same time. Making smart choices during Open Enrollment matters more than ever: Rising healthcare costs being one of the major reasons why.

A Health Savings Account, or HSA, is an account that is often paired with a high-deductible health insurance plan, or HDHP.

Depending on where you look, healthcare costs are increasing 2-3x normal inflation, including wage inflation. For those that don’t know, inflation is the rate at which prices increase. If all prices and wages go up at the same rate, then all is good. But when things like healthcare and education go up at 5-6% per year, and wages only go up at 1-2% per year, trouble ensues.

At first glance, a difference of 3-4% seems small, but when the muscular, powerful, compounding gets ahold of it, inflation becomes a monster. Purchasing power can easily be cut in half in 20 years, even with this kind of small differential.

Decreased purchasing power means healthcare is not as affordable as it once was. A larger portion of our paycheck is going to healthcare. Assuming a 4% differential between wages and healthcare costs; if healthcare made up 5% of our pre-tax income 18 years ago, it now makes up 10%.

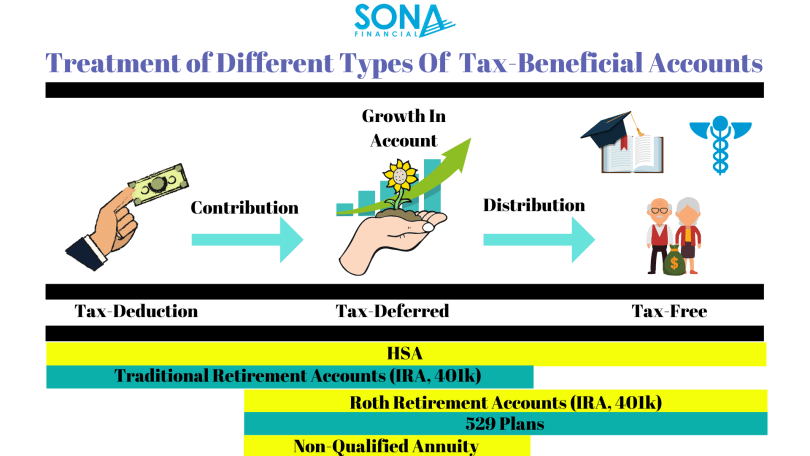

This new health care reality requires a more proactive approach by employees; and for many, the HSA is a great tool to help tame the health care inflation beast. If the HSA were a pro wrestler, its name might be Triple Tax Threat — no other account has three advantages (see graphic below).

,

Why?

- Money goes in tax free

- Money grows tax free

- Money comes out tax free, if used for qualifying health care expenses both before and in retirement (for what Medicare doesn’t cover and a certain amount for long-term-care premiums too)

Other HSA benefits:

- Not a use it or lose it, like an FSA

- No time limit on reimbursements

- The ability to invest and compound can work for, instead of against, you

- Investing can help you keep pace with inflation, even healthcare inflation

- In retirement (age 65+), the funds can be used for non-healthcare expenses with taxes paid without apenalty – like with a Traditional IRA or 401k

- Healthcare payments and reimbursement are very easy (you can even use your favorite credit card for the points, then reimburse yourself from the HSA!)

- Lower premiums

- Possible employer “seeding”

Why do many find HSAs so SCAAAAARY?

- The phrase “High Deductible” makes our tummies feel funny, like we ate too much Halloween candy

- Many employees don’t have an emergency fund to allow premium savings to build and get past the breakeven point

- You have to do the….. MATH (a very scary word!)

- Lack of HSA understanding causes inaction

- Requires more bookkeeping

But like most things scary (except for clowns, clowns are always scary), we fear what we don’t understand. This is especially true with the HSA. For many, the premium savings alone can more than make up for the higher deductible.

Do The Math

Here is how the math might go for a hypothetical family choosing between the high-deductible HSA plan and a possible no-deductible plan. Although, to make HSA plans more palatable, I am going to start a re-branding effort and call it a low-premium plan (we’ll see if catches on )

, Low-Premium HSA PlanLow-Deductible PlanMonthly Premium$350$600Deductible$3,0000Max Out Of Pocket$6,000$2,000

(For example, purposes only – your actual plan may differ)

This pretend family has a premium saving of $3,000 per year with the low-deductible plan. The family would have to go one year without dipping into the deductible (the breakeven point) for the low-premium plan to pay off. But that does not take into account other possible benefits, like the employer “seeding” the HSA.

Many employers will provide a yearly deposit into an HSA plan for the employee. From the example above, a typical employer deposit might be $1,000 per year. This effectively lowers the yearly deductible to $2,000 and the breakeven point to 8 months. The real power of all this is getting past the breakeven point and allowing the seeding and premium savings to grow. This is especially powerful when long-term investing and compounding is utilized.

Given HSA contributions are tax deductible, there could be additional benefits that could decrease the breakeven point but since most employee-paid premiums are pre-tax too, the calculation gets a little complex. Since even the best high-premium plan usually has some kind of copay, which can be paid for with HSA dollars with the low-premium plan, the tax benefit can be greater than people think. But, to keep things simple, we will say the tax benefits are a wash.

The key to low-premium plans is to get past the breakeven point to give the HSA account time to grow and compound. This is often easier for younger employees than older, but an option for most anyone with a large enough emergency fund or extra cashflow. There are reasons that emergency funds are preached about so often; they allow you take advantage of things like HSA plans. And once the HSA plan gets large enough, it can even be part of your emergency fund. It can be used for both routine and unexpected healthcare expenses.

Even if you or your family seek medical attention more than the average person, it is worth doing the math and looking at the pros and cons of using an HSA with a low-premium (high-deductible) plan. If used correctly, it can yield results both in the short and long-term.