Working with families, and having my own, I often use the seasons and holidays as signposts. They remind us of upcoming tasks or deadlines. Memorial Day is the start of summer, Labor Day, the end of summer. July 4this often a reminder that it’s time to get things together for back-to-school.

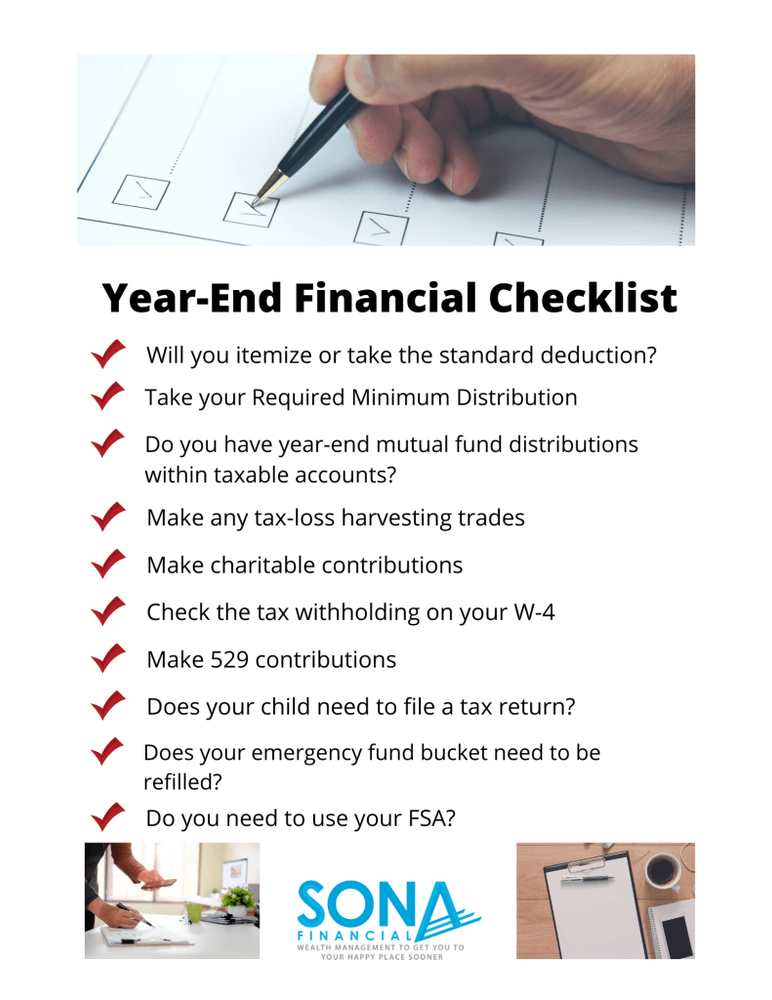

Thanksgiving should act as a reminder for all us to pull out our year-end financial checklist.

There are many items that have to be done by 12/31 and as we all know, the time between Thanksgiving and Christmas can disappear quickly. This is especially true if Thanksgiving falls later in November, as it does this year.

- Will you itemize or take the standard deduction?

- As of 2018, the standard deduction increased to the point for which most people don’t benefit from itemizing. However, but it is worth making sure.

- Take your RMD

- With the exception of the first one, the year after you turn 70.5, your Required Minimum Distribution, or RMD, must be done by 12/31

- Review mutual fund distributions within taxable accounts

- Mutual fund distributions are usually announced by late November. This gives you a chance to plan for the tax hit.

- Tax loss harvesting

- Now is the time to identify possible assets to harvest losses offset gains.

- After years of all markets going up at once, this can be tough to find.

- Just be careful of the wash sale rule.

- Charitable contributions

- With the new standard deduction being so high, charitable contributions don’t pack the punch they used to. But if you are going to make them, now is the time: They have to be completed before 12/31.

- Those who are over 70.5 can funnel their Required Minimum Distributions, or RMD, directly to a charity. If done correctly, this process is called a QCD, or Qualified Charitable Distribution, which provides substantial tax benefits and can satisfy the RMD.

- 401k contributions

- All employee 401k contributions must be made by 12/31.

- The max for 2019 is $19,000 and $25,000 for those over 50.

- Check the tax withholding on your W-4

- This can help prepare you for any tax payment or refund come April.

- It is also a good time to adjust your withholding to make sure 2020 is as you would like it.

- 529 contributions

- If your state gives a tax credit or deduction for contributing to a 529 Plan, it must be done by 12/31.

- Does your child need to file a tax return?

- Generally speaking, if your child makes more than a net of $400 in earned income from self-employment, they may need to file a tax return. This number is increased to $12,000, if a W-2 income.

- Also, now is a good time to plan any Roth IRA contributions you child may make, if they have earned income.

- Refill the emergency fund bucket

- The end of the year is a great time to refill the emergency fund bucket. This is critical for those still growing their net worth or for those who are retired. If timed around taxes, income, and distributions, all the better.

- FSA

- Flexible Spending Accounts, or FSAs, are use-it-or-lose-it, and 12/31 is the date to use it by. Some plans allow up to $500 to be rolled over, but many do not.

Being proactive instead of reactive puts you in a position to reduce financial stress and make the most of your personal situation for 2020 and beyond.

Each item listed may have rules or tax consequences not listed here. Please consult your tax or financial professional before making any final decisions.

For questions on working with Mark, visit www.SonaWealthAdvisors.com.

The MNice Investor is for educational purposes only. Investment Advisory Services are offered through Sona Financial LLC (DBA Sona Wealth and Sona Wealth Management), a registered investment adviser authorized to do business in states where registered or otherwise exempt from registration. Nothing discussed during this article/show/episode should be viewed as investment advice. If you have questions pertaining to your specific situation, please consult your own financial professional.