401ks are for retirement. With pensions going the way of the dodo bird, flip phones, and fax machines, our retirements are dependent on 401ks and Social Security.

While their primary purpose is retirement, 401k loans do have a feature that can be a great tool if used correctly: the ability to borrow money from yourself. If used incorrectly, they can cause permanent damage to your retirement.

With a 401k loan you can borrow up to 50% or $50,000 of your account balance.

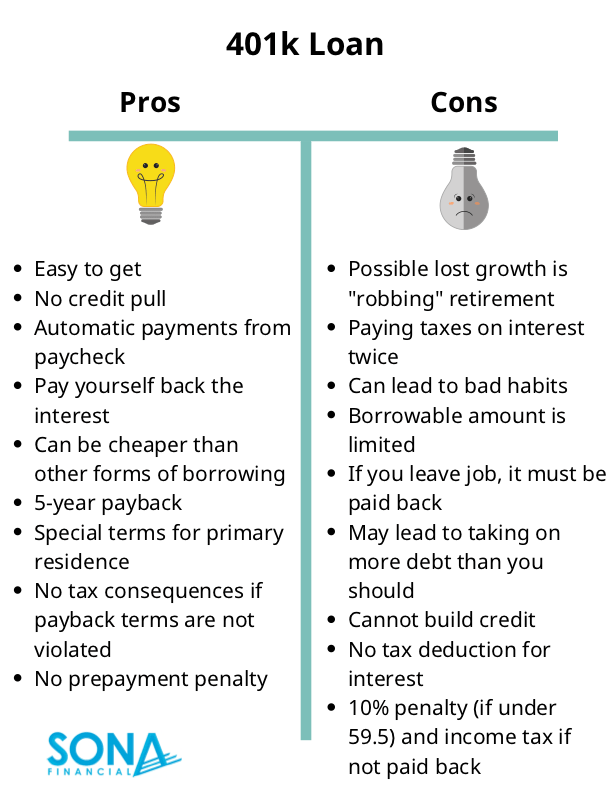

They main reasons a 401k loan can be a great option are:

- You pay yourself back the interest

- There is no credit pull, a 401k loan does not show up on your credit bureau report

- The loan is non-taxable event when paid back

- The loan payment automatically comes out of your paycheck

- Usually easy and fast to get

The main reasons a 401k may not be a great idea:

- The 401k loan funds are taken “out of the market” – no long-term growth

- Violates the golden rule of finance, “pay yourself first”

- May lose access to company match

- Easy access to the loan may lead to more debt than you can afford

- If you leave your company or get fired, the loan must be paid back

For additional pros and cons of 401k loans, see the handout provided below.

If you have a clear path forward, a clear plan to pay off your debt, the 401k loan can be a great tool. Just make sure you have a back-up plan. The 401k loan should not take the place of your emergency fund but should complement your emergency fund.